[ad_1]

What 2026 Means for Your Money: Navigating Economic Shifts for a Thriving Year Ahead

By Elena Vargas – Wellness & Nutrition Expert

Picture this: You’re starting your day with a nutrient-packed smoothie in your cozy kitchen nook, sunlight streaming in as you glance at your financial app—smiling because your balanced budget is fueling not just your body, but your dreams too. As a 42-year-old registered dietitian and mom of two in vibrant California, I’ve learned that what 2026 means for your money is all about harmony: blending smart strategies with economic realities to nourish your financial health. With global growth steadying and inflation easing, this year offers a fresh start to align your finances with wellness goals, like investing in that home gym or planning a rejuvenating family getaway. Drawing from expert forecasts, let’s dive into what 2026 means for your money and how to make it work for you—backed by data and actionable tips for radiant results.

In this comprehensive guide, we’ll explore economic projections, inflation trends, interest rate shifts, and more, all tied to practical steps for your personal finances. Whether you’re boosting savings or eyeing investments, understanding what 2026 means for your money empowers you to thrive.

Global Economic Growth: A Steady Climb with Opportunities

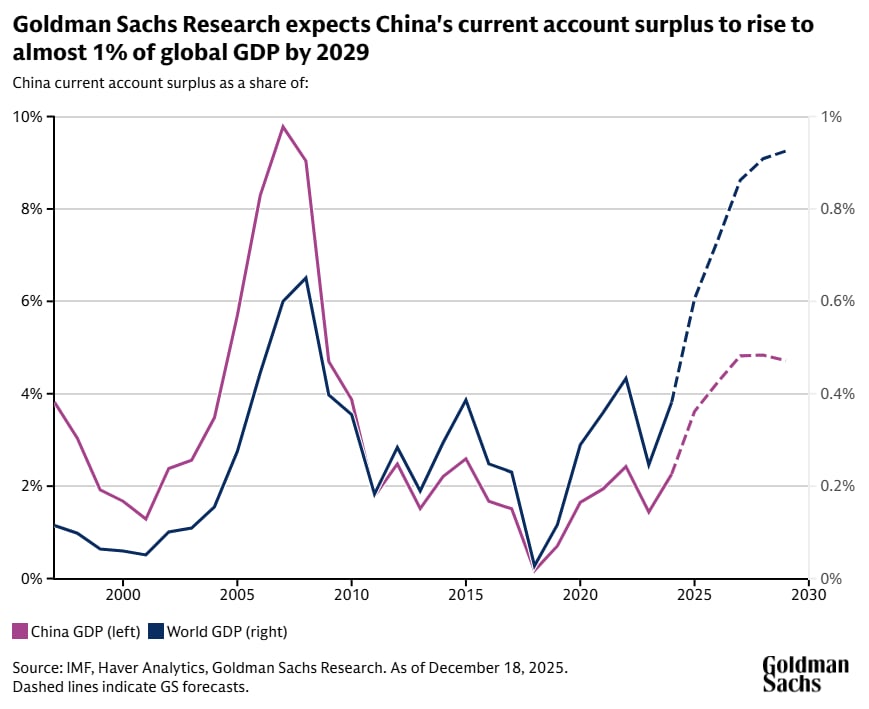

Global GDP is set to grow at a sturdy 2.8% in 2026, outpacing consensus estimates of 2.5%. This resilient outlook, driven by factors like reduced trade barriers and policy support, means job stability and potential wage increases for many. In the U.S., expect acceleration to around 2.2-2.6%, fueled by fiscal easing and AI advancements.

For families like mine, this translates to more room in the budget for wellness essentials—perhaps upgrading to organic produce or that Vitamix Blender for smoother meal prep. Globally, emerging markets could see stronger rebounds, offering diversification ideas like exploring sustainable living investments.

Alt text: Global GDP growth chart illustrating sturdy projections for 2026, key to understanding what 2026 means for your money.

U.S. Economy: Resilience Amid Challenges

Domestically, the U.S. is poised for 2.2% growth, with risks tilted downward due to tariffs but offset by stimulus. As someone who tracks hormone-balancing nutrition, I see parallels—steady progress requires balancing inputs like policy and consumer spending. Wage growth outpacing inflation could boost disposable income, ideal for funding nutrition guides or family health plans.

However, a K-shaped recovery persists, with higher earners driving spending. To bridge this, focus on side hustles—more on that later.

Inflation Trends: Cooling but Persistent Pressures

Inflation is expected to moderate to around 2.4-2.7% in the U.S., down from recent highs but above the Fed’s 2% target. This “sticky” trend, influenced by AI investments and tariffs, means everyday costs like groceries may stabilize, freeing funds for wellness.

In my routine, I combat this by meal prepping with affordable superfoods—try our healthy recipe hacks to stretch your dollar while nourishing your body.

Alt text: Inflation rate forecast graph showing cooling trends for 2026, essential for what 2026 means for your money planning.

Interest Rates: Gradual Easing Ahead

The Fed may cut rates once or twice more, bringing the benchmark to around 3% by year-end. Mortgages could hover near 6%, improving affordability slightly.

This is great for refinancing or starting that home-based wellness business. Lock in high-yield savings now—the exact insulated bottle I use for my smoothies reminds me to stay hydrated on financial goals too.

Alt text: Interest rates projection chart highlighting easing in 2026, crucial for what 2026 means for your money decisions.

Stock Market Outlook: Bullish with Volatility

The S&P 500 could rise 6-12%, targeting 7,500-8,000, driven by earnings growth amid AI buzz. Expect volatility from trade policies, but diversified portfolios in health tech could shine—link to exploring ai tools for jobs.

Alt text: Stock market S&P 500 forecast chart for 2026, guiding investment aspects of what 2026 means for your money.

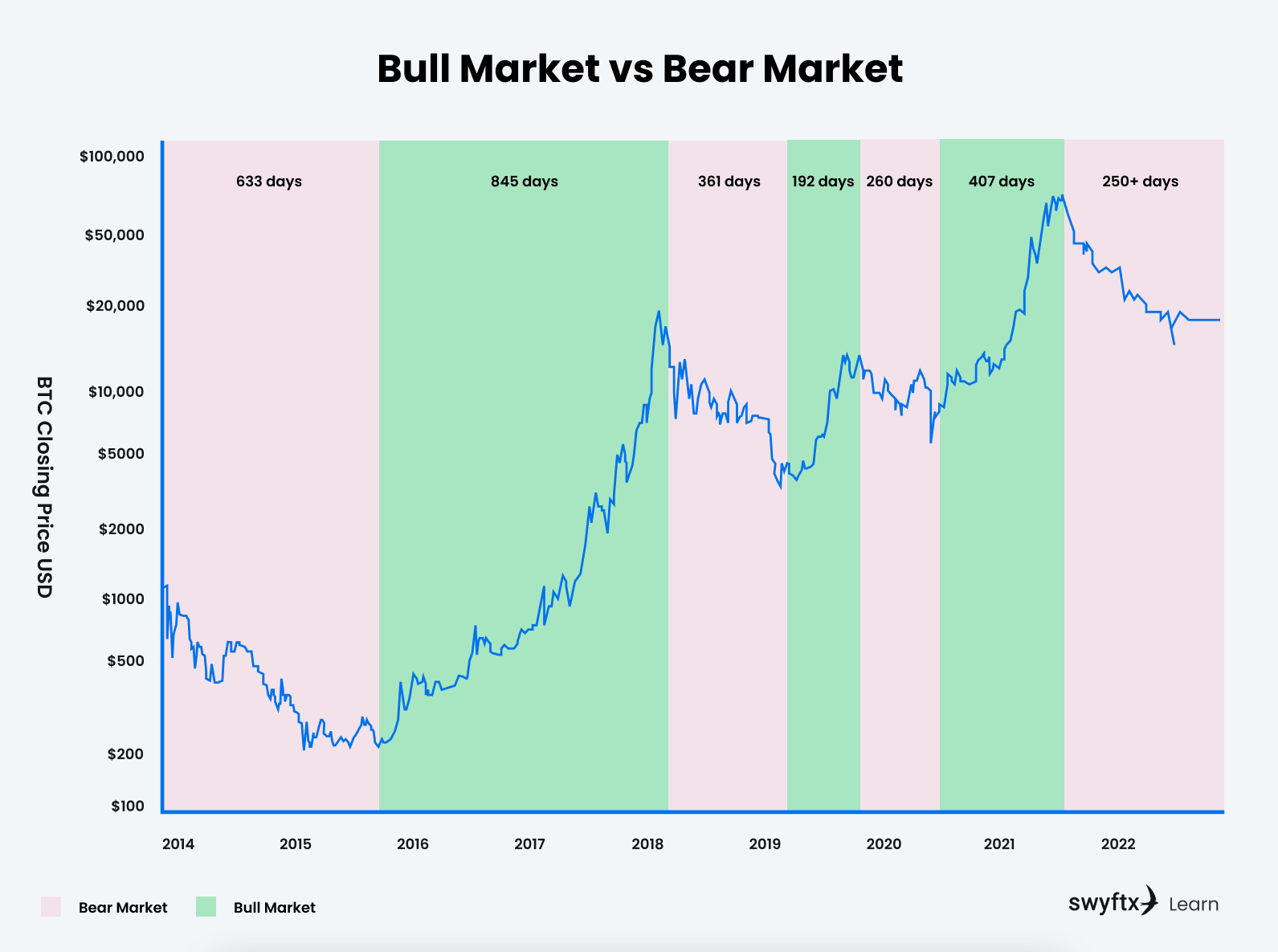

Cryptocurrency: Momentum Builds with Institutions

Crypto trends point to institutional adoption, tokenization, and stablecoins, with Bitcoin potentially hitting $180,000 and Ethereum $8,000. Start small, like adding understanding cryptocurrencies today to your knowledge base.

Alt text: Bitcoin price prediction chart showing upward trends for 2026, part of what 2026 means for your money in digital assets.

Real Estate: Modest Growth and Better Affordability

Home prices may rise 1-2%, with sales up 3-14% as inventory improves and rates stabilize around 6%. This “great reset” favors buyers—consider essential guide to van life as digital nomad in Ireland for alternative living.

Alt text: Real estate housing market trends illustration for 2026, informing property aspects of what 2026 means for your money.

Personal Finance Trends: AI, Side Hustles, and Tax Tweaks

Key trends include AI in budgeting, lower rates boosting hustles, and new tax rules from OBBBA. Embed AI for tracking—like apps for nurturing your mental fitness.

Alt text: AI in personal finance illustration depicting smart tools for 2026, enhancing what 2026 means for your money management.

Building Resilience: Wellness-Aligned Financial Strategies

Create a six-month emergency fund using tools like the financial planner journal—the exact one I use for tracking family nutrition and finances. Diversify with exploring augmented biology concepts in health investments.

Investment Plays: Balancing Growth and Sustainability

Target balanced portfolios with 10% potential. Consider Vital Proteins Collagen for daily use and similar stocks.

Explore embracing flexible work options today for income.

AI’s Role: Revolutionizing Your Money Management

AI will personalize advice and detect fraud. Tie to wellness via exploring ai close up perspectives.

Sustainable Finance: Money Meets Values

Green trends rise—use reusable silicon bags and eco-investments, linking to sustainable fabrics for everyday use.

Your 2026 Action Plan: Steps for Success

Review monthly, download financial independence roadmap.

Alt text: Family financial planning scene capturing collaborative budgeting for 2026, embodying what 2026 means for your money security.

Must-Read Books for Financial Mastery in 2026

- “Rich Dad Poor Dad” by Robert Kiyosaki – Build wealth mindsets.

- “The Intelligent Investor” by Benjamin Graham – Timeless investing.

- “Atomic Habits” by James Clear – Habit-based finance.

- “The Psychology of Money” by Morgan Housel – Behavioral insights.

- “Your Money or Your Life” by Vicki Robin – Sustainable approaches.

Essentials for Your Financial Toolkit

Here are seven must-haves to streamline your money management:

- Financial Planner Journal – Organize goals seamlessly.

- Leather Notebook – Jot ideas effortlessly.

- Insulated Bottle – Stay refreshed during sessions.

- Sunrise Alarm Clock – Wake productively.

- Smoothie Blender – Fuel smart decisions.

- Blue Light Glasses – Protect while researching.

- Portable Essential Oil Diffuser – Ease budgeting stress—currently 30% off, run!

P.S. Ready to thrive? Download our free Family Budget Planner to kickstart your 2026 journey and join our email list for wellness-finance tips!

Related Posts

[ad_2]