[ad_1]

Fast facts:

- Corporate bankruptcies have been increasing every quarter since June 2022.

- 23,309 American businesses filed for bankruptcy over the 12-month period ending March 31, 2025.

- In May of 2025, Rite Aid filed for bankruptcy protection for the second time in under two years. It is now in the process of selling off portions of its business piecemeal while closing all of its remaining stores in waves.

- Other major brands that have filed this year include Hooters, 23andMe, and Forever 21.

- Below is a list of this year’s biggest business bankruptcies, with a focus on the retail and dining sectors.

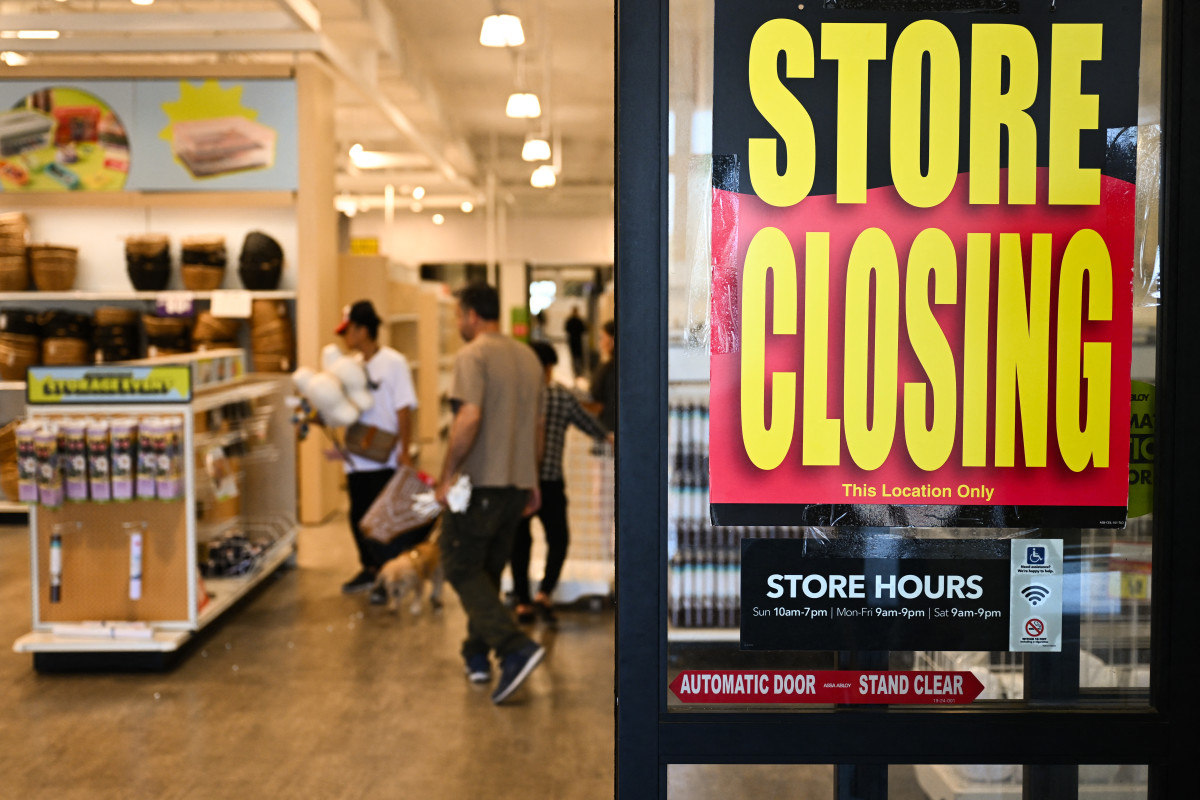

Corporate bankruptcy filings have been on the rise since 2022, with more businesses filing for court protection each quarter since June of that year, according to data from the United States Courts.

The reasons for this sharp increase in companies’ financial woes are many, and while they certainly vary between industries and individual businesses, certain factors have been taking a toll across the board.

The rate of inflation peaked in June of 2022 at over 9% as measured by the CPI, and while it’s mostly been falling since then, that doesn’t mean that prices are going down — it just means they’re not going up as quickly.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

The rising costs of both materials and labor mean businesses have been raising prices to protect their margins. Meanwhile, the cost of living continues to rise, and consumers continue to tighten their budgets, with many reducing their discretionary spending on things like dining out or buying non-essential products and services like new clothing, accessories, and entertainment.

Together, these factors have been eating into profits and cash flow, causing more and more businesses to find themselves unable to keep up with payments to their creditors—a situation that can quickly lead to a bankruptcy filing, and in some cases, insolvency, liquidation, and permanent closure.

TheStreet

Below, we cover the most startling bankruptcy filings of 2025 so far—particularly those in the retail and dining industries. The vast majority have been of the Chapter 11 variety, which means they aren’t necessarily a death sentence, and some of this year’s filers have already emerged from bankruptcy proceedings.

Dedicated customers of businesses still in bankruptcy court can take solace in the fact that even though their favorite restaurant or retailer fell too deep into the red, it may graduate from the restructuring process on healthier financial footing and eventually continue to operate as it had before.

Here are this year’s most startling corporate bankruptcies in reverse chronological order:

Merit Street Media

- Date: July 2

- Filing type: Chapter 11

Merit Street Media, a television network that produces programs featuring celebrities like Dr. Phil, Bear Grylls, and Steve Harvey, filed for Chapter 11 bankruptcy protection on July 2nd. The filing came just a little over a year after the company was founded by Dr. Phil in April of 2024.

In the filing, Merit Street Media listed assets of between $100 million and $500 million and liabilities in the same range. A representative for the company told TheStreet that as part of its restructuring process, it is suing Trinity Broadcasting Network, one of its distribution partners.

CMX Cinemas

- Date: June 30

- Type: Chapter 11

CMX Cinemas is a line of luxury bistro theaters at which moviegoers can order restaurant-style food and drinks. CMX’s parent company filed for Chapter 11 bankruptcy for the second time in under two years on June 30th. Back in 2020, when the company first filed, it had 41 locations, but that number has dropped to 28 as of its current filing, with the bulk of its remaining theaters (16) in the state of Florida.

At the time of the filing, the company listed $50 million to $100 million in assets and $1 million to $10 million in liabilities. As of this article’s publishing, CMX’s remaining locations are still operating, but according to Dan Kline of TheStreet, “Closing all of its locations remains an option for CMX.”

Related: The best gas grills under $250, ranked by Consumer Reports data

Sound Vision Care

- Date: June 23

- Filing type: Chapter 11

Sound Vision Care Inc., a New York-based chain of vision clinics, filed for Chapter 11 bankruptcy protection on June 23, listing $50,000 to $100,000 in assets and $1 million to $10 million in liabilities. At the time of the filing, which did not cite a particular cause, the company operated eight locations according to its website.

CaaStle

- Date: June 20

- Filing type: Chapter 7

CaaStle is a fashion brand that worked with brands and retailers to rent their unsold inventory to consumers seeking particular pieces of clothing on a temporary basis (e.g., for a special event). CaaStle’s Chapter 7 filing came less than three months after former CEO Christine Hunsicker resigned in the wake of a fraud scandal that resulted in the company losing over $500 million in previously promised funding.

In the filing, CaaStle listed between $10 and $50 million in both assets and liabilities. It is unclear how many of the company’s creditors will be made whole once the company finishes liquidating is assets.

Caraway Tea

- Date: June 9

- Filing type: Chapter 11

Caraway tea, a prominent importer and manufacturer of tea products, filed for Chapter 11 bankruptcy on June 9, listing $614,660 in assets and almost $2.7 million in liabilities. The company is a co-packer, meaning it works with brands that want to create and sell tea products by handling their sourcing, manufacturing, and distribution processes.

Related: The best environmentally friendly SUVs according to Consumer Reports

Intrepid USA

- Date: May 29

- Filing type: Chapter 7

Intrepid USA, a large, Texas-based home care and hospice provider, filed for Chapter 7 bankruptcy on May 29, listing between $1 million and $10 million in assets and $88 million in liabilities. The company, which has been in financial trouble for years, first filed for bankruptcy more than 20 years prior in 2004, after which it was purchased by Lynn Tilton’s Patriarch Partners, a firm that specializes in managing companies with debt issues. In 2024, however, it was sold to CenterWell Health Services and fined by the Department of Justice for submitting fraudulent medicare claims.

Rite Aid

- Date: May 5

- Filing type: Chapter 11

Rite Aid, once one of the largest and best-known pharmacy retailers in the U.S., filed for Chapter 11 bankruptcy protection on May 5, less than two years after its previous bankruptcy filing in October of 2023. The brand emerged from its previous bankruptcy as a private company with ownership divided among its previous creditors after closing around 800 stores and selling off its pharma benefit subsidiary, Elixir.

At the time of Rite Aid’s filing on May 5, the company listed between $1 billion and $10 billion in both assets and liabilities. As of early July, over 1200 stores remained nationwide, but the company had already begun the process of closing them in waves.

Nebraska Brewing Co.

- Date: April 28

- Filing type: Chapter 11

Nebraska Brewing Co., which operates a brewery and taproom in La Vista and also sells its beers to retailers, bars, and restaurants for resale, filed for Chapter 11 bankruptcy in late April.

According to the brewery’s leadership, the financial straits that led to the filing were spurred by supply chain issues and other economic pressures. Nevertheless, the company remains operational and hopes to emerge from the restructuring process and continue to serve its customers, according to a Facebook post.

The filing listed assets of between $100,000 and $500,000 and liabilities of between $1 million and $10 million. Paul and Kim Kavulak, the brewery’s majority owners, are among the creditors listed in the company’s bankruptcy filing.

Bertucci’s Restaurant Corp.

- Date: April 24

- Filing type: Chapter 11

Bertucci’s Restaurant Corp., operator of a regional chain of pizza restaurants on the East Coast, filed for Chapter 11 bankruptcy for the third time on April 24. The company has been on shaky financial footing for years, having closed around half of its locations since its previous filing in 2022.

Bertucci’s continued to close stores after its latest filing, which listed between $10 million and $50 million in both assets and liabilities. The day before the filing, however, the chain opened a new, fast-casual “Pronto” location in downtown Boston.

Consolidated Burger Holdings LLC (Burger King Franchisee)

- Date: April 14

- Filing type: Chapter 11

Consolidated Burger Holdings LLC, a large Burger King Franchisee that at its peak operated 75 of the chain’s restaurants, filed for Chapter 11 bankruptcy on April 14. The Debtor, which did not cite a reason for the filing, listed $50 million to $100 million in both assets and liabilities. In late 2024, Consolidated Burger Holdings reached a settlement with Burger King Corporate after a longstanding legal dispute over its franchise agreement.

Royal Paper

- Date: April 8

- Filing type: Chapter 11

Royal Paper, a manufacturer of toilet paper, paper towels, and other paper products, filed for Chapter 11 Bankruptcy on April 8, citing operational issues and supply-chain challenges as major contributors to its financial distress. Royal Paper produces store-brand toilet paper for stores like Aldi as well as its own brands, which include Earth First, SuperSoft, and EcoFirst.

The company, which listed assets and liabilities of between $100 million and $500 million in its petition, entered a “stalking horse” agreement with Sofidel America Corp., another toilet paper company, in which the latter will purchase the former’s assets for around $126 million.

Hooters

- Date: March 31

- Filing type: Chapter 11

Iconic American wing spot Hooters filed for Chapter 11 bankruptcy protection on March 31, listing between $50 million and $100 million in both assets and liabilities. As part of its restructuring process, the chain agreed to sell 100+ of its owned and operated locations to a group of buyers comprising two of the brand’s largest franchisees, Hooters Inc. and Hoot Owl Restaurants LLC.

Several months later, the chain announced that it would be closing 30 of its company-owned locations, including a number of restaurants in Florida and Georgia. Between the sales and closures of more than 130 corporate-owned stores, an increasing percentage of the brand’s American locations will be owned and operated by experienced franchisees, including the company’s founders.

The Dolphin Company (Gulf World Marine Park)

- Date: March 31

- Filing type: Chapter 11

Gulf World Marine Park owner The Dolphin Company filed for Chapter 11 bankruptcy on March 31 after a string of dolphin deaths and allegations about water quality and the treatment of the facility’s resident marine animals. At the time of the filing, the company listed assets and liabilities of between $100 million and $500 million. Some of the facility’s dolphins have since been relocated.

Related: The best free trading apps for retail investors (& what they offer)

Bar Louie

- Date: March 26

- Filing type: Chapter 11

Bar Louie, a Texas-based chain of gastropub-style bars and restaurants, filed for Chapter 11 bankruptcy for the second time in less than 10 years on March 26 in order to reorganize its finances and shut down less profitable locations.

At the time of the filing, which listed between $1 million and $10 million in assets and between $50 million and $100 million in liabilities, the chain was operating 48 restaurants. This is down from the 134 locations it was operating before it filed for bankruptcy for the first time in early 2020.

Plenty Unlimited

- Date: March 25

- Filing type: Chapter 11

Plenty Unlimited, an indoor vertical farming startup backed by financiers including Amazon founder Jeff Bezos, filed for Chapter 11 bankruptcy on March 25 in order to restructure and focus more specifically on strawberries. At the time of the filing, the company listed between $100 million and $500 million in both assets and liabilities. On May 29, the company completed its restructuring and emerged from bankruptcy proceedings.

23andMe Holding Co.

- Date: March 23

- Filing type: Chapter 11

23andMe, the popular mail-in DNA testing company, filed for Chapter 11 bankruptcy on March 23 after struggling with decreased demand, declining revenues, and the continued fallout from a massive 2023 data breach in which hackers obtained customers’ health and ancestry data. The filing listed between $100 million and $500 million in assets and liabilities, and the company continued to operate as it looked for a buyer.

Originally, biotech company Regeneron Pharmaceuticals won the bankruptcy auction, but it was later reopened, and the company was instead sold to TTAM Research Institute, a nonprofit run by the co-founder and former CEO of 23andMe, Anne Wojcicki. The nonprofit’s name is an acronym for 23andMe.

Forever 21

- Date: March 16

- Filing type: Chapter 11

Budget fashion retailer Forever 21, once a shopping mall mainstay, filed for Chapter 11 bankruptcy for the second time in six years on March 16, citing increased competition from online fast fashion retailers like Shein. The filing listed assets of between $100 million and $500 million and liabilities of between $1 billion and $5 billion.

At the time of the filing, the brand was hopeful to find a buyer for its stores, but one did not emerge in time, and all American Forever 21 locations have been closed permanently, although stores abroad were not affected. Authentic Brands Group owns the Forever 21 brand, so it is possible that it may find another licensee to operate the brand in the U.S. in the future.

Hudson’s Bay

- Date: March 14

- Filing type: Chapter 11

Hudson’s Bay, iconic department store chain holding company and the oldest company in North America, filed for Chapter 11 bankruptcy protection on March 14, listing around $3.7 billion in assets and around $3.2 billion in liabilities. The company cited declining sales, competition from online retailers, and international trade issues as contributing factors to its financial decline. As the company sought a buyer, it shut down its stores and liquidated its inventory, but on May 15, the Canadian Tire Corporation agreed to purchase the brand’s intellectual property for around $30 million.

Watchtower Firearms

- Date: February 27

- Filing type: Chapter 11

Texas-based gun manufacturer Watchtower Firearms filed for Chapter 11 bankruptcy on February 27, listing mounting debt, tax issues, and operational troubles as contributing factors in its decision to reorganize. At the time of the filing, the company listed between $10 million and $50 million in both assets and liabilities.

Nikola Corporation

- Date: February 19

- Filing type: Chapter 11

Arizona-based EV and hydrogen-powered vehicle startup the Nikola Corporation filed for Chapter 11 bankruptcy on February 19, listing assets of between $500 million and $1 billion and liabilities of between $1 billion and $10 billion. The filing came just several years after the company’s founder, Trevor Milton, was convicted of fraud for misleading investors about the nature of the company’s products. The company is currently in proceedings to sell its assets under the supervision of the bankruptcy court.

Liberated Brands (Quicksilver, Billabong, RVCA, Roxy retailer)

- Date: February 2

- Filing type: Chapter 11

Liberated Brands, former retail partner of brands like Quicksilver, Roxy, Volcom, and Billabong, filed for Chapter 11 bankruptcy on February 2. The filing came after Authentic Brands Group, the owner of those brands, terminated its licensing agreement with the retailer.

After the filing, which listed assets and liabilities valued between $100 million and $500 million, Liberated closed its corporate office and laid off thousands of staff. The brands formerly licensed to Liberated will remain available to consumers through other retail partners.

Related: The 10 most popular new cars & SUVs of 2025 (so far), according to Consumer Reports

Books Inc.

- Date: January 21

- Filing type: Chapter 11

Books Inc., a 174-year-old chain of bookstores based in the Bay Area, filed for Chapter 11 bankruptcy on January 21, citing declining revenues resulting from increased operating costs and changing consumer habits. As part of its restructuring process, the company closed one of its stores in the Berkeley area in February.

The filing listed between $1 million and $10 million in both assets and liabilities.

Joann

- Date: January 15

- Filing type: Chapter 11

Iconic 82-year-old craft retailer Joann filed for Chapter 11 bankruptcy for the second time in less than a year on January 15. The brand had faced a sharp decline in demand since the COVID-19 pandemic waned, and by the time of the filing, it had accumulated over $600 million in debt. Its bankruptcy petition listed between $1 billion and $10 billion in both assets and liabilities.

Unfortunately for crafters who prefer to shop in person, Joann began closing its remaining stores after its filing, and by the end of May, the final location had been closed permanently. Michaels, another brick-and-mortar craft supply destination, acquired some of Joann’s intellectual property and private label brands, including the popular Big Twist Yarn.

Surf9 (Body Glove supplier)

- Date: January 8

- Filing type: Chapter 11

Surf9, a company that designs and manufactures products for a variety of outdoor equipment and apparel brands, filed for Chapter 11 bankruptcy on January 8. The move followed a dispute with Marquee Brands, the parent company of popular surf brand Body Glove, for which Surf9 manufactures paddleboards.

The filing was also preceded by a recall on several of the company’s paddleboard models, primarily sold at warehouse club Costco, due to drowning concerns. At the time of the filing, Surf9 listed under $50 million in both assets and liabilities.

Related: The best 2025 cars under $25k based on Consumer Reports data

[ad_2]