[ad_1]

Citi is a TPG advertising partner.

Credit card welcome bonuses are one of the quickest ways to earn valuable travel rewards. You can often pick up 100,000 points or more in a single bonus, which can be worth thousands of dollars in travel.

Right now, American Airlines’ top-tier card is offering its best-ever welcome bonus, worth $1,650 (according to our May 2025 valuations). For a limited time, those who apply for the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) can earn 100,000 bonus AAdvantage miles after spending $10,000 in three months of account opening.

But what if you already have the card or have held it in the past? Can you earn the welcome bonus on it again?

To answer this question, it’s important to understand Citi’s application rules and identify the exact date when you last earned the welcome bonus on this card. Let me walk you through it.

Related: Is the Citi / AAdvantage Executive World Elite Mastercard worth it?

Understanding Citi’s application rules

On most of its cobranded cards, Citi restricts earning the welcome bonus to once every 48 months. This rule applies to the Citi / AAdvantage Executive World Elite Mastercard.

So, for example, if you wanted to apply for this card in May 2025 and earn the welcome bonus, you would only be eligible if you received your last welcome bonus on the card before May 2021.

The best way to find out this date is to call Citi at 888-766-2484. Alternatively, you could also call AAdvantage at 800-882-8880. (You can only see your account activity through your AAdvantage online account for the past two years.)

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Related: Who’s eligible for the 100K-mile Citi / AAdvantage Executive World Elite Mastercard bonus?

Timing is important

The 48-month period starts from the date the previous bonus was received, not when the account was opened or closed.

That’s important because a few months will probably have passed between when you were approved for the card and when you met the minimum spending requirement and, thus, received the welcome bonus.

Product changes

You can earn the welcome bonus on each of Citi’s AAdvantage cards once every 48 months — each product is treated separately.

In the past two years, I have applied for the following three Citi / AAdvantage cards and earned the welcome bonus on each:

However, suppose I had earned the bonus on my Platinum Select and then the product changed (or upgraded) it to the Executive. In that case, I would need to wait 48 months from when I received the Platinum Select welcome bonus to earn the welcome bonus on the Executive.

Strategies to maximize bonus opportunities

Here are some of my top tips to quickly earn a lot of AAdvantage miles by applying for cobranded American Airlines credit cards.

Work out your application strategy

If you are confident that you received the welcome bonus on your Executive card more than four years ago and don’t currently hold the card, you’re good to apply for it again.

If you do currently have the card, first, you’ll want to downgrade or cancel your card.

My recommendation would be to downgrade it to the no-annual-fee American Airlines AAdvantage® MileUp® card by calling Citi at the number on the back of your card. However, note that by downgrading, you will not be eligible for the welcome bonus on this card. The upside is that you will protect your credit score as there will be no change to your credit report.

The information for the AAdvantage MileUp card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Alternatively, you can cancel your Executive card. While this may temporarily hurt your credit score due to an increase in your credit utilization ratio, you may be eligible to earn the welcome bonus on the MileUp should you choose to apply for it in the future.

After downgrading or canceling your card, wait a week or so and then apply for the Executive card again.

Track bonus timelines

You may have received your welcome bonus on your Executive card more recently. In that case, find out the exact date you received your bonus. Then, use a bonus tracking spreadsheet or set a reminder to note when you will be eligible again.

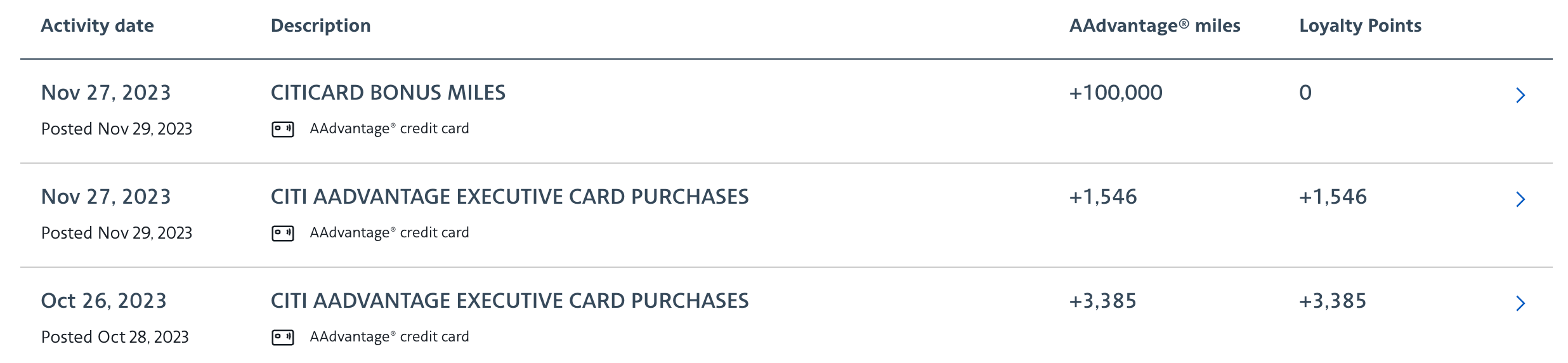

I applied for this card in July 2023, in the first week after the card was refreshed. According to my account activity in my online AAdvantage account, I received the welcome bonus in November 2023. So, I have put a note in my Google Calendar that I’m eligible to apply for this card again from December 2027.

Explore other AAdvantage cards

If you want to pick up more bonus AAdvantage miles, consider applying for one of the carrier’s other cards.

My top suggestion would be to pick up the AAdvantage Aviator Red World Elite Mastercard. It’s the only AAdvantage card that Barclays is still issuing, ahead of Citi becoming the carrier’s sole credit card partner next year. Applications for this card could close any day now (and almost definitely before the end of the year).

You are eligible to apply for it if you haven’t had it in the past six months. Here is a link to earn 10,000 extra miles on top of the card’s standard offer.

The information for the Aviator Red World Elite Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

If you haven’t earned the bonus on one of Citi’s other two personal cards or the business version in the past 48 months, then they are good options too.

Bottom line

Citi’s 48-month rule makes timing critical when applying for its AAdvantage credit cards. By tracking when you last earned a welcome bonus and understanding how product changes affect eligibility, you can ensure you maximize your approval chances.

With the 100,000-bonus-mile offer currently available on the Executive card, now is the time to evaluate your timeline and take full AAdvantage if you’re eligible.

To learn more about the card, read our full review of the Citi / AAdvantage Executive World Elite Mastercard.

Apply here: Citi / AAdvantage Executive World Elite Mastercard

[ad_2]