[ad_1]

ETHA Could Face Deeper Losses Than FBTC Over the Next Five Years

By Kai Novak – Tech Innovation Specialist

Did you know that in 2025, the iShares Ethereum Trust ETF (ETHA) suffered a staggering 64% maximum drawdown, nearly double the 32.6% dip seen in the Fidelity Wise Origin Bitcoin Fund (FBTC)? As a 32-year-old software engineer in my San Francisco loft, where I tinker with AI side projects during weekend coding sessions, I’ve watched these crypto trends unfold like a complex algorithm—full of potential but laced with volatility. While ETHA could face deeper losses than FBTC over the next five years due to Ethereum’s evolving ecosystem risks, this isn’t a doom-and-gloom forecast; it’s an empowering look at how understanding these dynamics can help you build a smarter, more resilient portfolio in the digital economy.

As we gear up for 2026, crypto ETFs like ETHA and FBTC are reshaping how tech-savvy investors access blockchain assets. Whether you’re optimizing your setup with automated alerts as I do or exploring diversification amid AI-driven market shifts, this guide breaks down performance, projections, and strategies. Let’s explore why ETHA could face deeper losses than FBTC, turning insights into actionable edges for your investments.

Decoding ETHA and FBTC: Core Differences in Crypto Exposure

ETHA, managed by BlackRock, tracks Ether’s spot price, giving direct access to Ethereum’s innovative world of smart contracts and decentralized apps. It’s a bet on Web3’s growth, where creativity fuels value. FBTC, from Fidelity, mirrors Bitcoin, often dubbed digital gold for its store-of-value strength.

Both feature a low 0.25% expense ratio, simplifying crypto entry without wallet hassles. Yet, Ethereum’s rapid upgrades contrast Bitcoin’s stability, hinting at why ETHA could face deeper losses than FBTC in volatile periods. In my loft, I monitor these via AI tools, much like automating home efficiencies.

Caption: Visual chart comparing ETHA and FBTC performance trends in crypto ETFs. Alt Text: ETHA vs FBTC performance chart highlighting potential deeper losses for ETHA over five years.

2025 Performance Review: A Tale of Two Drawdowns

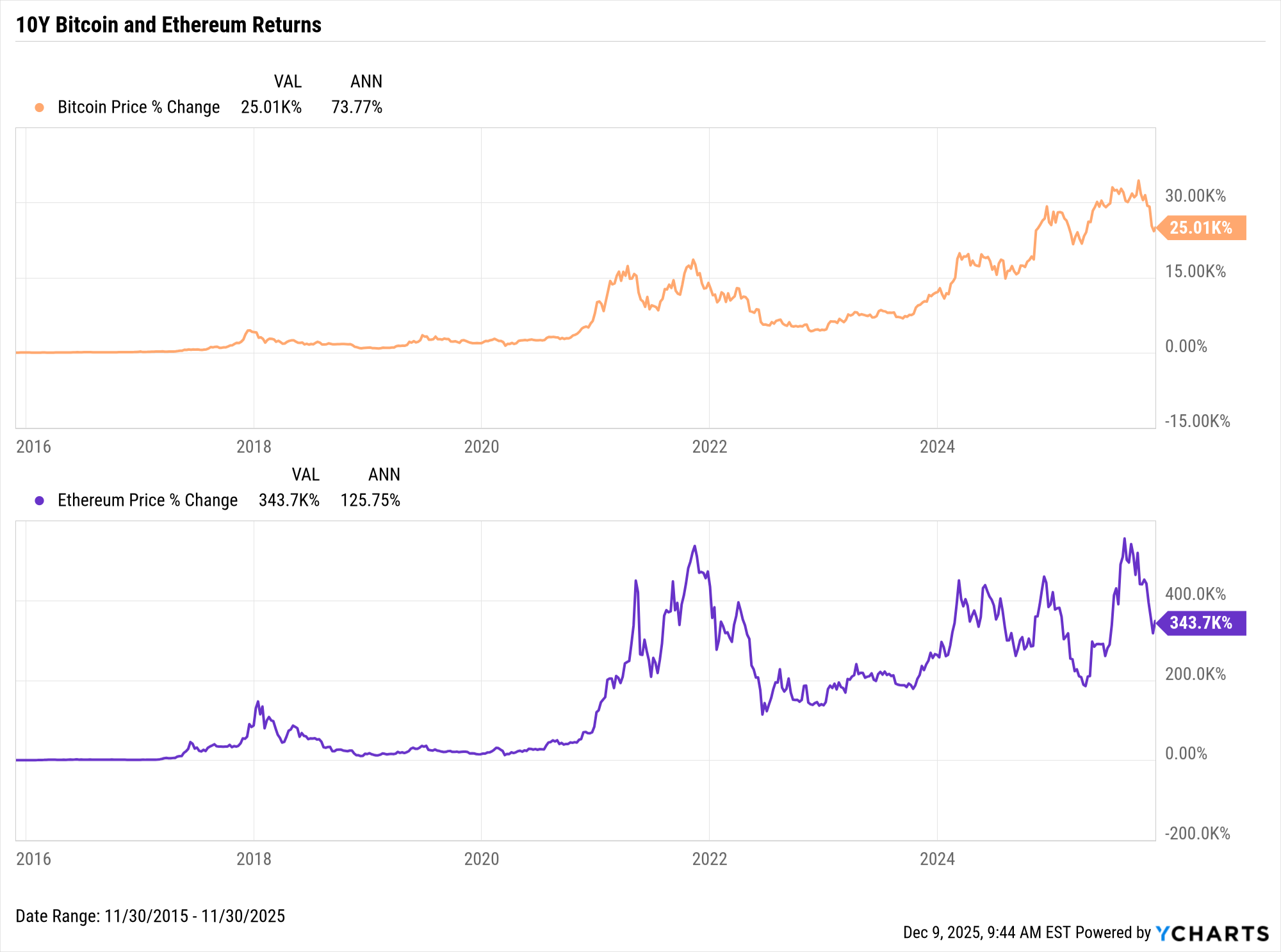

In 2025, ETHA posted a -24.9% one-year return with a 64% max drawdown, while FBTC saw -16.1% and a 32.6% dip. Assets under management reached $18.2 billion for FBTC versus $10 billion for ETHA, underscoring Bitcoin’s institutional appeal.

Through October, FBTC gained 56.7%, slightly ahead of ETHA’s 54.4%, but year-end volatility amplified ETHA’s swings. This pattern reflects Ethereum’s sensitivity to network changes, a factor that could drive deeper losses ahead.

Tie this to broader tech disruptions, like how AI is breaking entry-level jobs, where innovation brings both opportunity and risk.

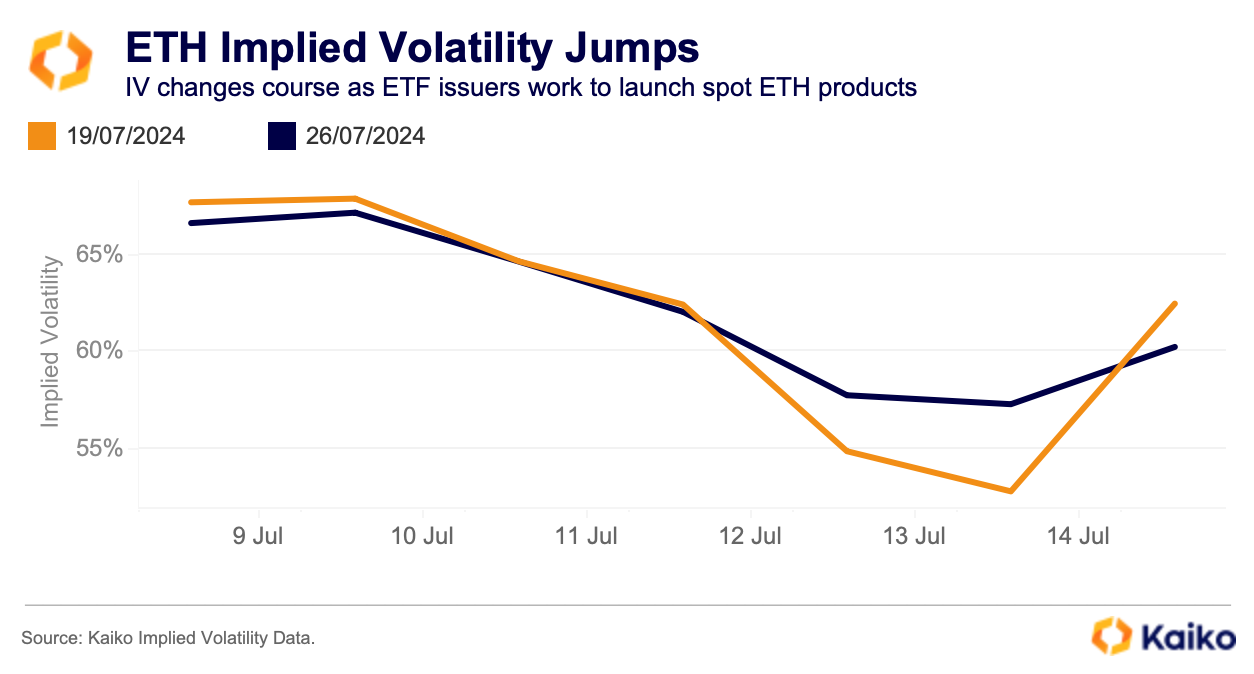

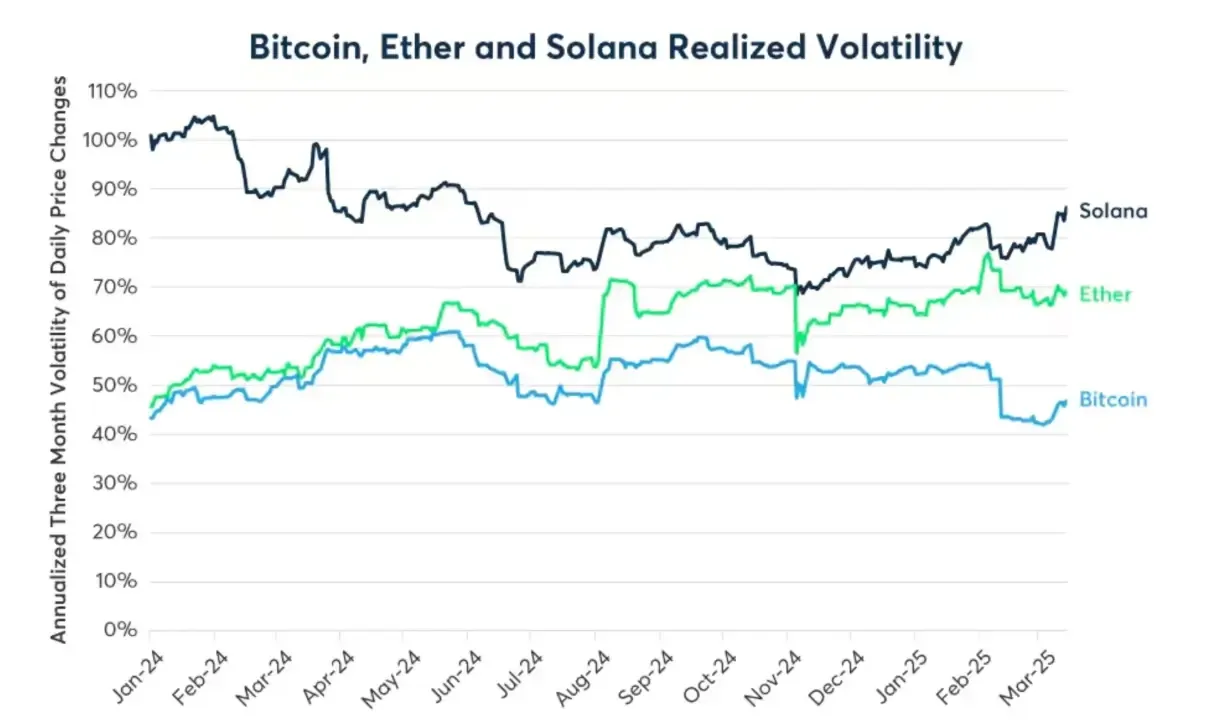

Volatility Breakdown: Why ETHA’s Risks Run Deeper

ETHA’s beta of -0.05 indicates inverse market moves during stress, but ecosystem risks like staking fluctuations or Solana competition heighten volatility. FBTC’s 2.63 beta aligns with tech stocks, offering more stability.

Drawdowns highlight this: ETHA’s 64% vs. FBTC’s 32.6%. As Nasdaq analysis notes, Ether’s evolution contrasts Bitcoin’s hedge role, potentially leading to sharper ETHA losses.

In my AI projects, I hedge risks with redundancies—apply similar logic here for balanced crypto plays.

Caption: Graph illustrating Ethereum ETF volatility patterns. Alt Text: Ethereum ETF volatility graph showing risks that could lead to deeper losses for ETHA compared to FBTC.

ETHA Outlook: Navigating 2026-2030 Projections

WalletInvestor projects ETHA at $49.60 by 2030, up from around $20 today. Changelly sees Ether at $7,000 in five years, boosting ETHA.

Risks include potential dips to $1,800-$2,000 in early 2026 if sentiment sours. Upgrades like layer-2 scaling promise growth, but volatility could deepen losses.

BlackRock’s staking proposals might enhance appeal, yet competition looms.

FBTC Forecast: Stability in 2026-2030 Horizons

FBTC could reach $272 by 2030 per Stockscan. Bernstein eyes Bitcoin at $200,000 by end-2025, with further gains.

Institutional adoption and ETF inflows absorbing new issuance buffer downsides. This stability positions FBTC for milder losses than ETHA.

Like my coding marathons, steady progress wins long-term.

Caption: Illustration of Bitcoin ETF’s stable growth trajectory. Alt Text: Bitcoin ETF stable growth illustration emphasizing why FBTC may avoid deeper losses like ETHA.

Key Reasons ETHA Could Face Deeper Losses Than FBTC

Ethereum’s upgrades spark rallies but also corrections, amplifying ETHA’s volatility. Bitcoin’s simpler narrative draws steadier inflows, reducing FBTC drawdowns.

Market dynamics, per AInvest, suggest ETHA’s downside could widen over five years. Diversify to mitigate, echoing strategies in better EV stocks like QuantumScape vs ChargePoint.

Hidden Opportunities in Crypto ETFs Amid Risks

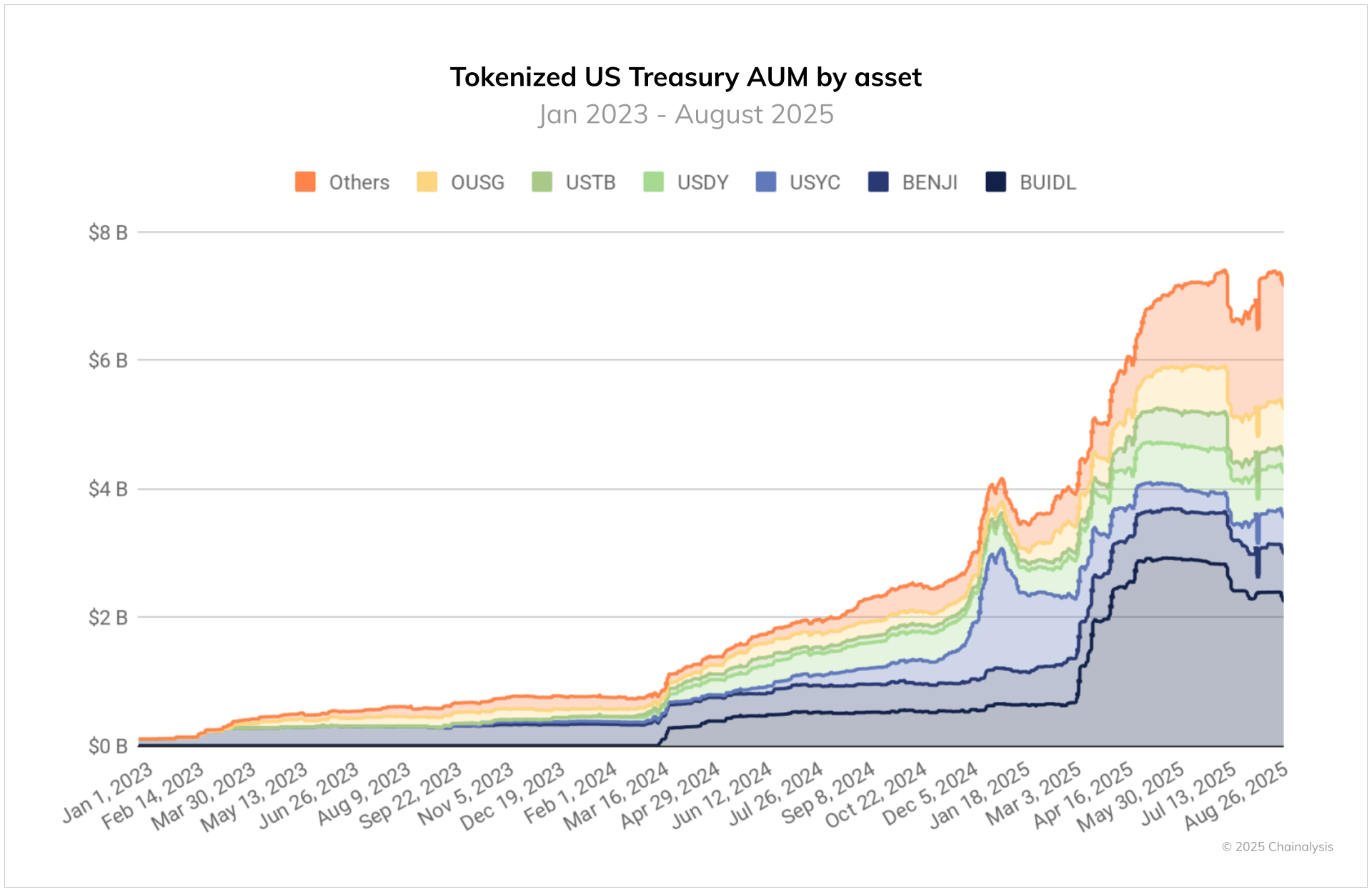

Despite risks, ETHA taps Ethereum’s DeFi and NFT boom. FBTC offers reliable Bitcoin exposure.

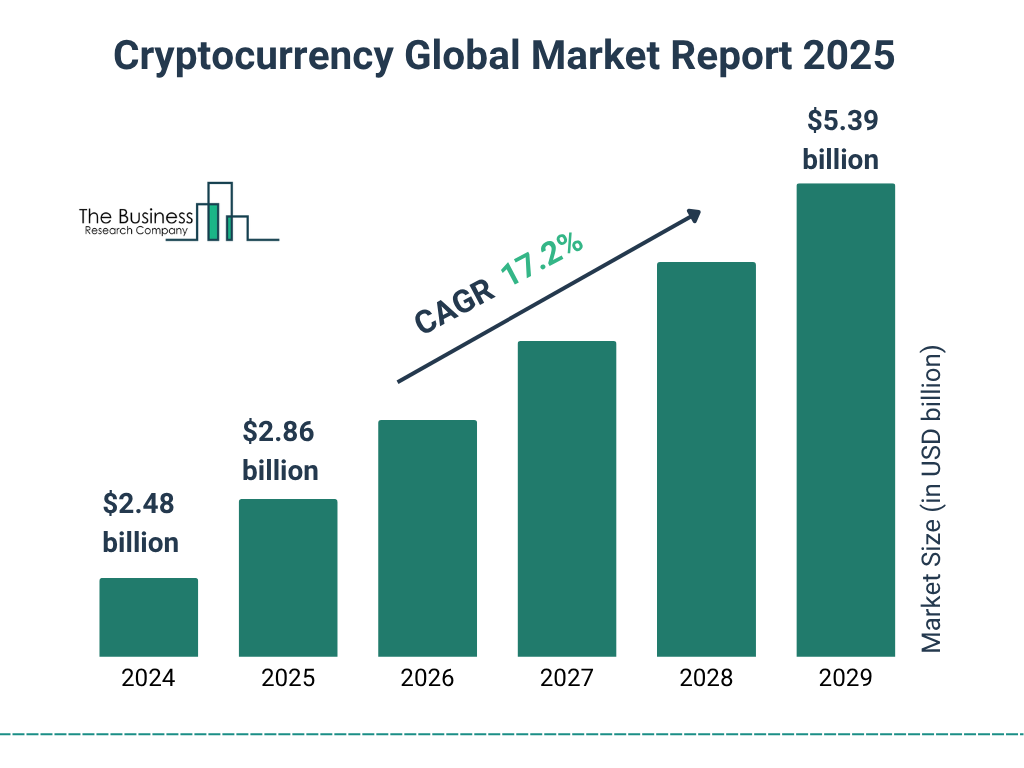

2026 may see 100+ new ETFs, with regulatory tailwinds boosting both. High risk equals high reward, like my AI ventures.

Link to unstoppable stocks potentially joining the $1 trillion club.

Caption: Projection of crypto market trends heading into 2026. Alt Text: Crypto market trends 2026 projection illustrating potential for ETHA deeper losses vs FBTC.

Smart Diversification: Blending ETHA and FBTC

Balance with 60% FBTC for stability, 40% ETHA for growth. Use ETF comparisons for tweaks.

Consider ties to exploring AI tools for jobs for tech-synced portfolios.

Broader Market Trends Shaping ETHA vs FBTC

Bitcoin ETFs saw $22 billion inflows in 2025, vs. $10.3 billion for Ethereum. Staking innovations could narrow the gap.

Watch for policy shifts, as in understanding cryptocurrencies today.

Pro Tips for Thriving in Volatile Crypto ETFs

Dollar-cost average to smooth dips. Use apps for alerts—my loft setup relies on them.

Study basics via high-DA resources. Integrate with AI in investing guides.

Caption: Another view of ETHA vs FBTC performance in crypto ETFs.

Must-Have Essentials for Your Crypto Investing Setup

Elevate your analysis with these Amazon picks—the ones powering my coding sessions:

- The Intelligent Investor by Benjamin Graham – Essential wisdom for volatile markets.

- Dell UltraSharp 32-inch Monitor – The exact one I use for charting ETHA vs FBTC, now 20% off—grab it quick.

- Logitech MX Master 3S Mouse – Precision for swift trades.

- Anker 737 Power Bank – Keeps devices juiced during market monitoring.

- Sony WH-1000XM5 Headphones – Noise-cancelling focus, the pair fueling my AI projects.

- Seagate Portable External Hard Drive – Secure backups for portfolio data.

- Logitech Mechanical Keyboard – Efficient typing for in-depth analysis.

- BigBlue 28W Solar Charger – Off-grid power for on-the-go trading.

These tools have revolutionized my approach—integrate them for your advantage.

Caption: Additional Ethereum ETF volatility visualization.

Wrapping Up: Transforming ETHA Risks into Portfolio Wins

While ETHA could face deeper losses than FBTC over the next five years from higher volatility, the crypto realm overflows with innovation potential. Stay informed, diversify wisely, and you can convert challenges into triumphs, just as my AI tweaks streamline daily life.

Explore more in how to make money from what you already know.

P.S. Eager for more on tech-fueled investing? Sign up for my free tech innovation newsletter—brimming with tips, trends, and insights to elevate your strategy.

Related Posts

[ad_2]