[ad_1]

Expert Tips From A Self-Made Millionaire & Financial Expert

By Kai Novak – Tech Innovation Specialist

This guide will show you how to unlock financial freedom with expert tips from self-made millionaires and financial experts who’ve built empires from scratch. Whether you’re debugging your budget like a glitchy app or optimizing your income streams for peak performance, these strategies blend timeless wisdom with modern hacks to supercharge your wealth-building journey. As a 32-year-old software engineer who’s seen how smart systems can transform chaos into clarity, I’m excited to share insights that have helped countless innovators turn side hustles into seven-figure successes. Let’s dive in and code your path to prosperity!

In today’s fast-paced digital world, achieving millionaire status isn’t about luck—it’s about adopting proven habits that compound over time. Drawing from real-world advice shared by self-made titans, we’ll explore actionable steps to elevate your finances. Expert tips from a self-made millionaire and financial expert emphasize consistency, mindset shifts, and strategic risks that pay off big.

Bootstrap Your Business for Full Ownership

One of the most unconventional pieces of advice from self-made millionaires is to bootstrap your ventures whenever possible. This means funding your startup with your own savings or revenue rather than seeking outside investors right away. By doing so, you retain complete control and avoid diluting your equity. As Grant Sabatier, author of “Financial Freedom,” puts it, owning it all allows you to make decisions that align with your vision without external pressures.

In my own tech side projects, I’ve bootstrapped apps that grew into profitable tools by reinvesting early earnings. Start small: Validate your idea with a minimum viable product, track expenses meticulously, and scale organically. This approach not only builds resilience but also teaches you the value of every dollar earned.

Live Below Your Means to Accelerate Savings

A cornerstone habit among millionaires is living frugally, even as income rises. Financial experts stress that wealth accumulates when you spend less than you earn, creating a surplus for investments. Tom Corley, who studied 177 self-made millionaires for his book “Rich Habits,” found that 94% save at least 20% of their income annually.

Picture this: Instead of upgrading to a luxury car, channel that cash into a high-yield savings account or index funds. I keep my urban loft efficient with smart home tweaks that cut utility bills by 30%—simple automations like energy-monitoring plugs make it effortless. Apply the 50-30-20 rule: 50% on needs, 30% on wants, and 20% on savings. Over time, this habit turns modest earnings into massive wealth.

Caption: Visualizing your budget can make planning fun and effective—start today for a brighter financial future.

Automate Your Finances for Effortless Growth

Why manually manage money when tech can do it for you? Self-made millionaires automate everything from bill payments to investments, ensuring consistency without the hassle. David Bach, founder of FinishRich.com, calls this the “latte factor”—small automated savings add up exponentially.

Set up direct deposits to split your paycheck: 10% to retirement, 10% to an emergency fund, and the rest for living. Apps like Acorns round up purchases and invest the change automatically. In my workflow, I use tools like Mint to track spending in real-time, alerting me to tweaks before they become issues. Automation removes emotion, letting compound interest work its magic while you focus on innovation.

Leverage Debt Wisely as a Tool, Not a Trap

Contrary to popular belief, not all debt is bad—millionaires use it strategically to amplify returns. Good debt, like mortgages or business loans, can generate income exceeding the interest cost. A Huntington Bank study of multi-millionaires highlights leveraging debt for investments as a key habit.

For instance, borrowing at 4% to invest in assets yielding 8% nets you profit. But caution: Avoid high-interest consumer debt like credit cards. I financed my first AI side project with a low-rate loan, paying it off early from revenues. Always calculate ROI and have a repayment plan—think of debt as rocket fuel for your financial engine.

Build Multiple Income Streams for Security

Relying on one paycheck is risky; self-made millionaires diversify with side hustles, investments, and passive income. Ramit Sethi, host of Netflix’s “How to Get Rich,” advises creating streams that work independently.

Start with freelancing your skills—coding gigs on Upwork, for example—or invest in dividend stocks. Rental properties or online courses provide ongoing revenue. My gadget reviews blog generates affiliate income while I sleep. Aim for seven streams, as many millionaires do, to weather economic storms and accelerate wealth.

Caption: Diversifying income is like building a robust network—stronger together for long-term success.

Invest Consistently, No Matter the Market

Millionaires invest like clockwork, ignoring short-term fluctuations. Warren Buffett’s mantra: Be fearful when others are greedy, and greedy when others are fearful. Consistent contributions to 401(k)s or IRAs harness compounding.

Begin with low-cost index funds via Vanguard or Fidelity. I automate bi-weekly investments into tech ETFs, riding waves without panic selling. Remember, time in the market beats timing the market—start early, stay disciplined, and watch your portfolio grow exponentially.

Cultivate a Purpose-Driven Mindset

Financial success stems from purpose, not just profit. Experts like George Kamel note that millionaires with clear goals save more thoughtfully.

Define your “why”—family security, philanthropy, or innovation? This fuels motivation during tough times. In my loft, daily affirmations via smart mirrors remind me of my mission to democratize AI tools. Journal your purpose; it aligns spending with values, cutting wasteful habits naturally.

Avoid Emotional Spending and Impulse Buys

Keep emotions out of finances—millionaires make data-driven decisions. Impulse purchases erode wealth; instead, implement a 48-hour rule for non-essentials.

Track triggers like stress-shopping with apps. I use budgeting software to categorize expenses, revealing patterns for optimization. Shift focus to experiences over things—hiking with coffee from home beats retail therapy every time.

Caption: Adopting success habits daily transforms your financial trajectory—small steps lead to big wins.

Network and Seek Expert Advice

No one builds wealth alone—millionaires surround themselves with advisors. Collaborate with financial planners, accountants, and mentors for insights.

Join communities like LinkedIn groups or masterminds. My weekend coding sessions with peers sparked lucrative partnerships. Invest in knowledge: Books, podcasts, or courses from sites like Coursera keep you ahead.

Delay Gratification for Long-Term Gains

“Delay your consumption for 10 years,” advises one millionaire—sacrifice now for abundance later.

Skip the latest gadgets; invest instead. This builds discipline and wealth. I delayed vacations early on, channeling funds into stocks that tripled. The reward? Freedom to travel luxuriously now.

Learn from Failures as Stepping Stones

View mistakes as lessons—millionaires analyze setbacks to improve. Dennis Vong broke the habit of fearing failure, turning it into growth.

After a failed app launch, I pivoted, leading to my current successes. Keep a failure journal: What went wrong? How to fix? This mindset turns obstacles into opportunities.

Save Aggressively and Build an Emergency Fund

Prioritize a robust safety net—six months’ expenses in liquid assets. Millionaires save first, spend later.

High-yield accounts like Ally offer better returns. I automate transfers post-payday, treating savings as a non-negotiable bill. This cushion enables bold moves without fear.

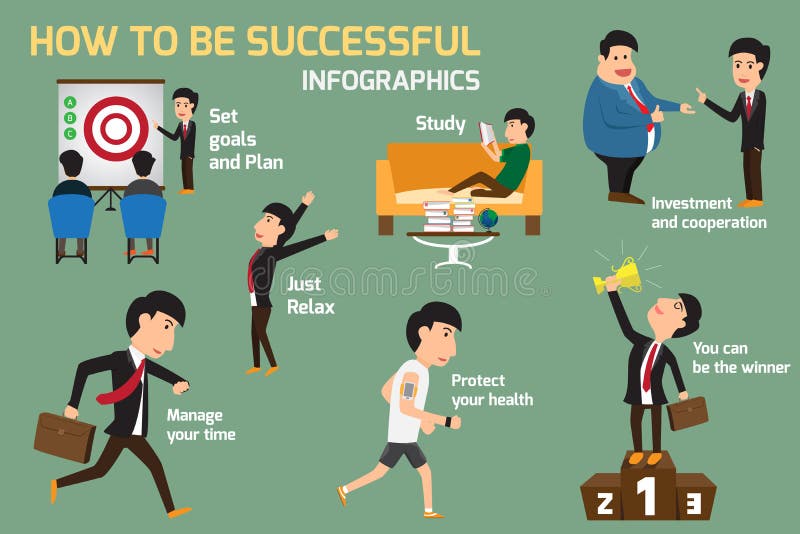

Caption: Infographics like this break down millionaire habits into actionable insights—print one for your workspace!

Essential Tools for Financial Success

To implement these tips, equip yourself with the right gear. Here are seven must-haves that keep my finances on track—the exact ones I use daily for seamless planning and productivity.

Start with a solid foundation using this financial planner journal to map out your goals and track progress effortlessly.

For jotting quick ideas during coding marathons, this leather notebook is durable and inspires creativity.

Monitor your health to maintain peak performance with this Oura Ring, which tracks sleep and activity for better decision-making.

Stay hydrated and energized with this insulated bottle during long work sessions—it’s leak-proof and keeps drinks cold for hours.

Diffuse focus-boosting scents with this essential oils diffuser to create a productive home office environment.

Capture notes on the go with this wellness journal, perfect for reflecting on financial wins and lessons.

Finally, organize your thoughts with this ergonomic laptop stand, elevating your setup for comfortable, efficient budgeting sessions.

To complement the financial success theme, here are five relevant books on building wealth through millionaire habits, mindset shifts, and practical strategies. Each one draws from real self-made success stories and actionable advice:

- Dive deeper into accelerated wealth-building with Financial Freedom: A Proven Path to All the Money You Will Ever Need by Grant Sabatier—a roadmap for side hustles and smart investing.

- Uncover daily routines that separate the wealthy from the rest in Rich Habits: The Daily Success Habits of Wealthy Individuals by Tom Corley—based on years of research into high-net-worth behaviors.

- Automate your path to riches with The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich by David Bach—focusing on simple systems for long-term financial growth.

- Get no-nonsense personal finance tactics in I Will Teach You to Be Rich by Ramit Sethi—a six-week program tailored for young adults building wealth.

- Learn the surprising frugal secrets of everyday millionaires in The Millionaire Next Door: The Surprising Secrets of America’s Wealthy by Thomas J. Stanley—dispelling myths about true financial independence.

These tools aren’t just purchases—they’re investments in your future self.

As we wrap up, remember: Expert tips from a self-made millionaire and financial expert aren’t about overnight riches but daily disciplines that compound. Implement one habit today, and watch your net worth soar. For more on building resilience, check out our post on effective habit stacking techniques. Or dive into understanding financial literacy basics for foundational knowledge.

External resources like Forbes’ guide on millionaire habits or Harvard Business Review’s article on purpose-driven success can deepen your understanding.

P.S. Ready to map out your path to financial freedom? Grab our free Financial Independence Roadmap and start building your wealthy life today! Sign up here: Financial Independence Roadmap

Related Posts

[ad_2]